Explains CNBC is What | fintech and its impact

Fintech significantly alters traditional banking by enhancing customer experiences and introducing innovations, while facing challenges such as regulatory compliance, data security, and building consumer trust.

Explains CNBC is What | fintech is more than just a buzzword; it’s a driving force in the financial industry. Have you ever wondered how it affects your banking and investment experiences? In this article, we’ll explore the essentials of fintech and its broader implications.

Understanding fintech: Key concepts and definitions

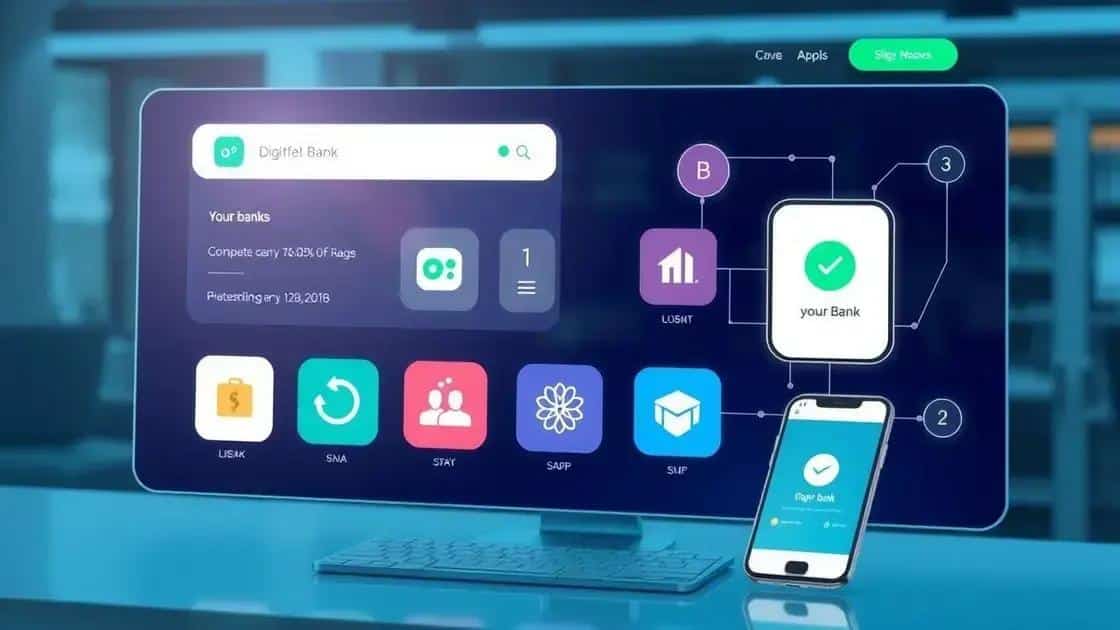

Understanding fintech is essential in today’s digital financial landscape. Fintech stands for financial technology, and it encompasses a variety of software and services that make financial operations simpler and more efficient.

At its core, fintech integrates technology with financial services to improve how consumers and businesses engage with money. This includes anything from mobile banking apps to blockchain technology.

The Role of Technology in Finance

Technology plays a critical role in the development of fintech. Innovations such as artificial intelligence, machine learning, and data analytics help organizations optimize efficiency and enhance customer experience.

Key Concepts of Fintech

- Digital Payments: Fintech facilitates digital transactions through mobile wallets and online payment systems.

- Peer-to-Peer Lending: Platforms allow individuals to lend and borrow money directly without traditional banks.

- Robo-Advisors: Automated investment services that manage portfolios using algorithms.

- Cryptocurrency: Digital currencies that utilize blockchain technology for secure transactions.

Understanding these key concepts is crucial for grasping the vast potential of fintech. As we move forward, the integration of these technologies in daily financial transactions will continue to evolve.

As businesses adopt fintech solutions, the implications are profound. With fintech, transactions become faster, safer, and more convenient, greatly benefiting consumers and revolutionizing the financial industry.

Many individuals now rely on fintech for everyday banking needs without even realizing it. Apps for budgeting, investment tracking, and even cryptocurrency trading have become part of our daily lives.

The rise of fintech: Trends and statistics

The rise of fintech has been remarkable over the past few years. As technology continues to evolve, the financial sector is experiencing unprecedented changes and innovations. Consumers are now looking for more convenient, efficient, and personalized financial solutions.

With the increasing use of smartphones and the internet, more people are engaging with financial services through digital platforms. In fact, studies show that over 70% of consumers prefer using digital tools for their banking needs.

Current Trends in Fintech

Several key trends are shaping the future of fintech. These trends highlight how companies are adapting to meet the demands of a digital-savvy audience. Notably, the rise of mobile banking is at the forefront. Customers value the ability to manage their finances anytime and anywhere.

- Blockchain Technology: This technology is revolutionizing the way transactions are verified and recorded, providing enhanced security.

- Artificial Intelligence: AI is used for customer service automation and fraud detection, enhancing user experience.

- Regtech: Regulatory technology is emerging to help companies comply with legislation efficiently.

- Open Banking: This trend allows third-party developers to access banking data, fostering innovation.

Moreover, statistics reveal that global investments in fintech have skyrocketed, reaching over $100 billion annually. This level of investment illustrates the significant potential and confidence investors have in this sector.

As we look ahead, the trends will likely continue to evolve, shaping how individuals and businesses use financial services. By embracing the innovation and technology of fintech, we can anticipate a more inclusive and efficient financial system.

How fintech is changing traditional banking

How fintech is changing traditional banking is a topic that highlights the transformative effects of technology in the financial sector. Banks are adapting to a new landscape where digital solutions are becoming essential for survival.

Many customers now expect seamless online experiences, which is pushing banks to innovate. Traditional brick-and-mortar institutions face pressure to enhance their services by integrating fintech solutions.

Enhancing Customer Experience

One of the most significant impacts of fintech on banking is the improvement in customer experience. Digital banking apps allow users to manage their accounts, make payments, and apply for loans from their devices.

- Personalized Services: Fintech harnesses data to offer tailored financial advice and product recommendations.

- Faster Transactions: Instant payments and quick loan approvals are becoming standard.

- User-Friendly Interfaces: Many fintech solutions prioritize design, making navigation simpler for users.

- 24/7 Access: Customers can access their accounts anytime, reducing reliance on traditional banking hours.

The rise of neobanks and digital-only banks has further accelerated this trend. These institutions operate entirely online, offering lower fees and more accessible services. Their flexibility appeals to young and tech-savvy consumers.

Furthermore, traditional banks are adopting features such as AI-driven chatbots for customer service, helping to resolve issues quickly and efficiently. With these advancements, the gap between traditional banking and fintech continues to narrow.

As fintech evolves, the necessity for collaboration between traditional banks and tech-driven companies becomes evident. Instead of viewing each other as competition, many financial institutions are recognizing the benefits of partnerships to enhance their offerings.

Challenges faced by the fintech industry

The challenges faced by the fintech industry are significant as it disrupts traditional financial services. Despite its rapid growth, fintech companies must navigate various obstacles that can impact their success.

One of the main challenges is the regulatory landscape. As fintech solutions become more prevalent, regulators are striving to keep up. Compliance with evolving regulations can be complex and costly for startups and established firms alike.

Data Security and Privacy

Another pressing issue is data security. Fintech companies handle sensitive information daily, making them prime targets for cyberattacks. Protecting customer data is not only crucial for trust but also vital for maintaining compliance with laws like GDPR.

Building Customer Trust

Building customer trust can be difficult in an industry filled with new players. Many consumers are still hesitant to adopt digital banking solutions due to concerns about security and reliability. Fintech businesses must work diligently to educate their users about safety measures and the benefits of their services.

- Market Competition: The fintech space is crowded, with numerous companies competing for the same customers. Standing out becomes a challenge.

- Technology Integration: Fintech firms often need to integrate with existing financial systems, which can be technically complex.

- User Adoption: Encouraging customers to transition from traditional banking to fintech solutions can be slow.

- Funding Challenges: Although investment in fintech is rising, securing sufficient funding can be challenging for new entrants.

Addressing these challenges requires innovation and cooperation. Many fintech firms are finding solutions through partnerships with traditional banks, leveraging their resources and knowledge to navigate the complexities of the financial environment. The landscape is fluid, and the ability to adapt will dictate the future of fintech.

FAQ – Frequently Asked Questions about Fintech Challenges

What are the biggest challenges faced by fintech companies?

The biggest challenges include regulatory compliance, data security, and building customer trust.

How does regulation affect fintech innovation?

Regulations can create hurdles for fintech companies, making it challenging to navigate compliance while innovating.

Why is data security crucial for fintech?

Data security is essential as fintech companies handle sensitive financial information, making them targets for cyberattacks.

How do fintechs build customer trust?

Fintechs build trust by ensuring data security, providing transparency, and delivering reliable services.