Maximize ROI: Federal Loan Guarantees for Clean Energy 2026

Securing federal loan guarantees in 2026 is crucial for large-scale clean energy infrastructure projects, offering a strategic pathway to significantly lower interest rates and enhanced return on investment.

In the dynamic landscape of 2026, securing federal loan guarantees clean energy projects can be a game-changer for large-scale infrastructure, potentially reducing interest rates by as much as 10% and significantly boosting your return on investment. This comprehensive guide will walk you through the essential steps to navigate this powerful financial mechanism, ensuring your clean energy initiatives are not only sustainable but also exceptionally profitable.

understanding federal loan guarantees in 2026

Federal loan guarantees represent a cornerstone of government support for strategic sectors, and in 2026, clean energy infrastructure stands at the forefront. These guarantees essentially mitigate risk for private lenders, encouraging them to provide financing for projects that might otherwise be deemed too risky or capital-intensive. The federal government, through various agencies, pledges to repay a portion or all of a loan if the borrower defaults, thereby reducing the lender’s exposure.

This reduction in risk directly translates to more favorable lending terms for clean energy developers. Lenders, assured by the government’s backing, are often willing to offer lower interest rates, longer repayment periods, and more flexible covenants. For large-scale projects, where financing costs can represent a substantial portion of the overall budget, even a small percentage reduction in interest can lead to millions of dollars in savings over the project’s lifespan, dramatically improving project economics.

the role of government agencies

Several key government agencies play pivotal roles in administering these loan guarantee programs. Understanding their specific mandates and target sectors is crucial for identifying the most suitable program for your project. Each agency has unique criteria, application processes, and priorities, which evolve with policy shifts and market demands.

- Department of Energy (DOE) Loan Programs Office (LPO): This office is a primary driver, offering guarantees for innovative clean energy technologies and advanced fossil energy projects. Their focus often includes projects that demonstrate significant environmental benefits or utilize cutting-edge, commercially viable technologies.

- USDA Rural Development: For projects located in rural areas, USDA programs can be an invaluable resource, often supporting renewable energy systems, energy efficiency improvements, and bio-refinery development.

- Export-Import Bank of the United States (EXIM): While primarily focused on supporting U.S. exports, EXIM can guarantee loans for international clean energy projects that utilize U.S. goods and services, indirectly benefiting domestic manufacturers and service providers.

Navigating these agencies requires a deep understanding of their specific program requirements and a tailored approach to your application. A thorough review of their current guidelines and past project approvals can provide invaluable insights into their preferences and evaluation criteria. The benefits extend beyond just reduced interest rates, encompassing enhanced project credibility and access to a broader pool of capital.

eligibility criteria for large-scale projects

Securing federal loan guarantees for large-scale clean energy infrastructure demands meticulous attention to specific eligibility criteria. These criteria are designed to ensure that federal support is directed towards projects that are technically sound, financially viable, and aligned with national energy priorities. Understanding these requirements from the outset is paramount to developing a successful application.

Typically, projects must demonstrate a significant contribution to clean energy production, energy efficiency, or carbon reduction. This often means focusing on technologies like large-scale solar farms, wind power installations, advanced nuclear reactors, carbon capture and storage, or grid modernization initiatives. The scale of the project is also a key factor; these guarantees are generally reserved for initiatives requiring substantial capital investment, often in the hundreds of millions or even billions of dollars.

technical and financial viability

The technical soundness of your project is rigorously evaluated. This includes demonstrating proven technology or, if innovative, a clear pathway to commercial viability. A comprehensive technical due diligence report, often prepared by independent engineers, is crucial. This report should detail the project’s design, construction plan, operational procedures, and expected performance metrics, all supported by robust data and analysis.

- Proven Technology: For established technologies like utility-scale solar or wind, the focus is on performance history and reliability.

- Innovative Technologies: For newer technologies, applicants must show strong research and development, pilot project success, and a clear path to market readiness and scalability.

- Environmental Impact: Projects must comply with all relevant environmental regulations and demonstrate a net positive environmental impact.

Financial viability is equally critical. Applicants must present a robust financial model that projects strong cash flows, a reasonable economic internal rate of return (EIRR), and sufficient equity contribution from project sponsors. The government wants to see that your project can repay the loan, even with the guarantee in place. This includes detailed revenue projections, operational cost estimates, and a comprehensive risk assessment with mitigation strategies. A strong balance sheet and proven track record of the project sponsors are also highly regarded.

the application process: a step-by-step guide

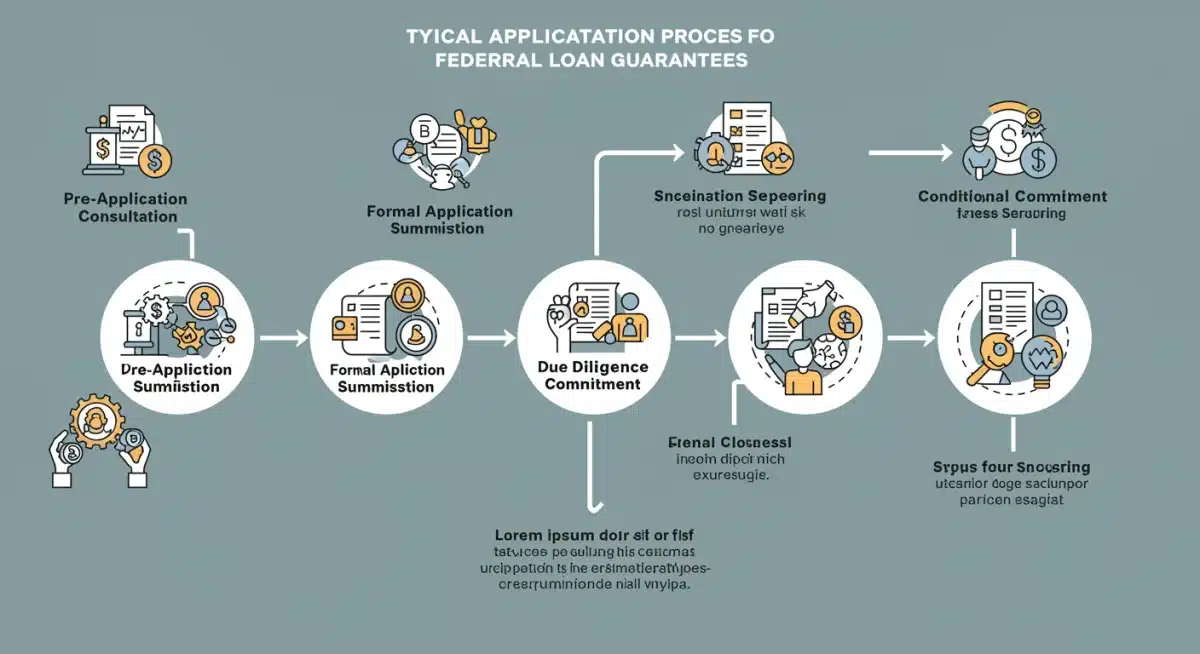

Navigating the federal loan guarantee application process is a multi-stage endeavor that requires precision, patience, and a deep understanding of governmental requirements. It’s not merely filling out forms; it’s about building a compelling case for your project’s technical merit, financial robustness, and alignment with national clean energy objectives. Each step is critical, and a misstep can lead to significant delays or outright rejection.

The process typically begins with an initial consultation or pre-application phase where project sponsors engage with the relevant agency to discuss their project’s eligibility and fit within existing programs. This early engagement is invaluable for receiving feedback and understanding the agency’s current priorities. It allows for preliminary vetting and helps refine your project proposal before investing significant resources into a full application.

pre-application and formal submission

The pre-application phase often involves submitting a concept paper or preliminary information describing the project, its technology, financial structure, and expected benefits. This allows agency staff to provide guidance and suggest improvements. Once the agency indicates interest, the formal application process begins, which is considerably more intensive.

- Detailed Project Description: A comprehensive overview of the project’s scope, location, technology, and construction plan.

- Technical Due Diligence: Reports from independent engineers verifying the technical feasibility and performance projections.

- Financial Model: A robust, auditable financial model detailing revenue, expenses, debt service, and projected returns.

- Legal Documentation: All relevant legal agreements, permits, and regulatory compliance documents.

- Environmental Review: Documentation demonstrating compliance with environmental regulations and impact assessments.

After formal submission, the application enters a rigorous due diligence phase. Agency experts, often supported by external consultants, meticulously review every aspect of the project. This can include site visits, interviews with key personnel, and in-depth analysis of all submitted documentation. The goal is to identify and assess all potential risks, from technical and operational to financial and environmental. Successful navigation of this phase often leads to a conditional commitment, outlining the terms and conditions under which the guarantee would be issued. The final step involves satisfying all conditions precedent and closing the financing, a complex legal process that requires meticulous coordination among all parties.

maximizing interest rate reductions with federal backing

One of the most compelling advantages of securing federal loan guarantees is the potential for significant interest rate reductions. These reductions can profoundly impact a project’s financial viability and overall return on investment. The government’s backing transforms the risk profile of a loan, making it far more attractive to commercial lenders, who then pass on these benefits in the form of lower borrowing costs.

For large-scale clean energy infrastructure, a 10% reduction in interest rates can translate into substantial savings over the typical 15-20 year (or longer) loan terms. Consider a project requiring $500 million in debt financing. A 10% reduction in interest (e.g., from 6% to 5.4%) could save millions annually, directly contributing to higher net income and improved project cash flow. This not only makes the project more appealing to investors but also frees up capital that can be reinvested or used to enhance other aspects of the project.

quantifying the savings and enhancing roi

To fully appreciate the impact, project developers should perform detailed financial modeling that compares scenarios with and without federal loan guarantees. This analysis should quantify the present value of future interest savings and demonstrate the uplift in key financial metrics.

- Net Present Value (NPV) Increase: Lower interest expenses directly boost the project’s NPV, making it a more attractive investment.

- Internal Rate of Return (IRR) Improvement: Reduced financing costs improve the project’s IRR, often a critical hurdle rate for investors.

- Debt Service Coverage Ratio (DSCR) Enhancement: Lower debt service requirements lead to a healthier DSCR, indicating greater capacity to meet debt obligations.

Beyond the direct financial savings, federal loan guarantees also confer a degree of financial stability and credibility. This can attract a wider pool of lenders and investors, further enhancing the project’s overall financing terms. The explicit government support signals a lower risk profile, which can be invaluable in a competitive capital market. This enhanced financial standing can also facilitate easier access to subsequent rounds of financing or refinancing, perpetuating a cycle of advantageous capital access for the project.

risk mitigation and due diligence for applicants

While federal loan guarantees offer significant financial advantages, they also come with a stringent requirement for robust risk mitigation and comprehensive due diligence from the applicant’s side. The government, in providing its backing, essentially assumes a portion of the project’s financial risk, and as such, it demands a thorough understanding and management of all potential vulnerabilities. Applicants must demonstrate a proactive and sophisticated approach to identifying, assessing, and mitigating risks across various dimensions.

This meticulous scrutiny ensures that taxpayer money is protected and that only projects with a high probability of success receive federal support. Therefore, a successful application hinges not only on the project’s inherent strengths but also on the applicant’s ability to articulate and manage its risks effectively. This involves a deep dive into every facet of the project, from its conception to its long-term operational phase.

comprehensive risk assessment framework

A critical component of the application is a detailed risk assessment framework. This framework should systematically identify all potential risks and outline clear, actionable mitigation strategies. This goes beyond a simple list of risks; it requires a demonstrated understanding of their likelihood and potential impact.

- Technical Risks: Addressing potential issues with technology performance, construction delays, or operational inefficiencies. This includes independent engineering reviews and contingency plans.

- Financial Risks: Thorough analysis of market volatility, off-take agreement stability, interest rate fluctuations, and currency risks (if applicable). Robust financial modeling with stress testing is essential.

- Regulatory and Permitting Risks: A clear understanding of all required permits, regulatory approvals, and potential changes in policy that could impact the project.

- Environmental and Social Risks: Compliance with environmental regulations, community engagement plans, and strategies for managing social impacts.

The due diligence conducted by the federal agencies is exhaustive, covering technical, financial, legal, environmental, and managerial aspects. Applicants should anticipate this level of scrutiny and prepare all documentation accordingly. This includes providing detailed contracts, permits, financial statements, market studies, and environmental impact assessments. Strong project management and governance structures are also key, demonstrating the applicant’s capacity to execute the project successfully and manage its ongoing operations. Transparency and responsiveness throughout the due diligence process are vital for building trust and facilitating a smooth review. Any identified weaknesses must be addressed directly and convincingly, showcasing a realistic and pragmatic approach to project execution.

post-guarantee compliance and reporting

Securing a federal loan guarantee is a significant achievement, but it marks the beginning of an ongoing commitment to compliance and reporting. The federal government, as a guarantor of your loan, maintains a vested interest in the project’s success and financial health. Therefore, projects benefiting from these guarantees are subject to continuous oversight and must adhere to strict reporting requirements throughout the loan’s tenure. This ensures accountability, transparency, and the continued protection of taxpayer interests.

Compliance extends beyond financial reporting to encompass operational performance, environmental standards, and adherence to all terms outlined in the loan guarantee agreement. Failure to meet these obligations can lead to serious consequences, including the revocation of the guarantee or other penalties. Therefore, establishing robust internal systems for monitoring and reporting from the outset is not just good practice but a mandatory requirement for all guaranteed projects.

ongoing monitoring and financial stewardship

Agencies typically require regular financial statements, operational reports, and updates on project milestones. These reports allow the government to track the project’s progress, assess its financial performance, and identify any potential issues early on. The level of detail and frequency of reporting can vary depending on the specific program and the size and complexity of the project.

- Quarterly and Annual Financial Reports: Detailed income statements, balance sheets, and cash flow statements, often audited by independent firms.

- Operational Performance Metrics: Reports on energy generation, efficiency rates, carbon reductions, and other key performance indicators relevant to the project’s mission.

- Compliance Certifications: Regular affirmations of adherence to environmental, labor, and other regulatory requirements.

- Material Event Reporting: Immediate notification of any significant events that could impact the project’s financial health or ability to repay the loan.

Effective post-guarantee management requires meticulous record-keeping, a dedicated compliance team, and open communication with the guaranteeing agency. Project sponsors should view the reporting requirements not as a burden, but as an opportunity to demonstrate strong financial stewardship and continued project viability. Proactive engagement and transparency in reporting can strengthen the relationship with the federal agency and ensure the long-term success of the guaranteed project. This includes promptly addressing any inquiries or concerns raised by the agency and demonstrating a commitment to continuous improvement and risk management throughout the project’s lifecycle.

strategic planning for successful outcomes in 2026

Achieving success in securing and managing federal loan guarantees for large-scale clean energy infrastructure in 2026 demands more than just meeting eligibility criteria; it requires strategic foresight and meticulous planning. The competitive landscape for federal funding is intense, and agencies are increasingly prioritizing projects that not only demonstrate technical and financial robustness but also align with broader national strategic objectives for energy transition and economic development. A well-crafted strategy can significantly enhance your project’s chances of approval and ensure long-term operational success.

This strategic approach involves anticipating future policy shifts, understanding emerging technological trends, and building strong relationships with key stakeholders. It’s about positioning your project as a leader in the clean energy sector, showcasing its potential for innovation, job creation, and substantial environmental impact. Thinking several steps ahead allows applicants to tailor their proposals to resonate deeply with the agencies’ evolving priorities, thereby increasing their appeal and securing crucial federal backing.

leveraging partnerships and innovation

Building strategic partnerships can play a pivotal role in strengthening your application and project execution. Collaborations with established technology providers, experienced construction firms, reputable financial institutions, and even academic research bodies can add significant credibility to your proposal. These partnerships demonstrate a robust support network and shared expertise, which are highly valued by federal agencies.

- Technology Innovation: Highlight how your project incorporates cutting-edge technologies or innovative approaches that advance clean energy goals.

- Economic Impact: Emphasize job creation, local economic development, and community benefits derived from the project.

- Environmental Leadership: Showcase superior environmental performance, beyond minimum compliance, such as significant carbon footprint reduction or ecosystem restoration.

Furthermore, demonstrating a clear commitment to innovation and continuous improvement can set your project apart. Federal agencies are often keen to support projects that push the boundaries of clean energy technology and contribute to the nation’s leadership in this sector. This includes plans for future upgrades, research and development components, or strategies for integrating new technologies as they emerge. A comprehensive strategic plan will not only secure the guarantee but also lay the groundwork for a resilient, impactful, and financially rewarding clean energy project for decades to come, ensuring its relevance and continued contribution to a sustainable future.

| Key Point | Brief Description |

|---|---|

| Reduced Interest Rates | Federal guarantees significantly lower borrowing costs for large-scale clean energy projects, enhancing ROI. |

| Rigorous Eligibility | Projects must demonstrate strong technical and financial viability, aligning with national energy goals. |

| Complex Application Process | Requires detailed documentation, extensive due diligence, and ongoing communication with federal agencies. |

| Post-Guarantee Compliance | Ongoing reporting and adherence to terms are crucial for maintaining the guarantee and project success. |

frequently asked questions about federal loan guarantees

Eligible projects typically include large-scale initiatives in renewable energy (solar, wind, geothermal), advanced nuclear, carbon capture, grid modernization, and energy efficiency. The specific focus often depends on the administering agency, such as the DOE’s LPO for innovative technologies or USDA for rural development projects.

Federal loan guarantees can significantly reduce interest rates, often by 5-10% or more, depending on the project’s risk profile and market conditions. This reduction stems from the government’s backing, which lowers the perceived risk for private lenders, allowing them to offer more favorable terms.

Applicants must present a robust financial model demonstrating strong cash flows, a healthy economic internal rate of return, and sufficient equity contribution. Agencies look for projects that are financially viable, with a clear ability to repay the loan even without the guarantee being called upon.

The application process can be lengthy, often taking 12 to 24 months, or even longer, from initial consultation to final closing. This duration is due to the extensive due diligence, technical reviews, financial assessments, and legal negotiations involved in securing federal backing.

Yes, post-guarantee, projects are subject to continuous compliance and reporting requirements. This includes submitting regular financial statements, operational performance data, and certifications of adherence to environmental and contractual terms throughout the loan’s duration to ensure accountability.

conclusion

Securing federal loan guarantees in 2026 represents a powerful opportunity for large-scale clean energy infrastructure projects to significantly enhance their financial viability and accelerate their development. By diligently navigating the complex application process, demonstrating robust technical and financial merit, and committing to ongoing compliance, project developers can unlock substantial interest rate reductions and maximize their return on investment. The strategic alignment with national clean energy goals, coupled with meticulous planning and strong partnerships, will be paramount for those aiming to capitalize on these critical federal programs. Ultimately, these guarantees are not just financial instruments; they are catalysts for a sustainable and prosperous energy future.