2026 Clean Energy Business Tax Credits: SME Benefits Guide

Small and Medium Enterprises (SMEs) in the United States can significantly benefit from the 2026 Clean Energy Business Tax Credits, which offer substantial financial incentives for embracing sustainable energy solutions and reducing their environmental footprint.

As we navigate the evolving economic landscape, understanding the financial incentives available to businesses is more crucial than ever. For Small and Medium Enterprises (SMEs), the landscape of sustainable growth is particularly promising, thanks to the 2026 Clean Energy Business Tax Credits: A Comprehensive Look at Benefits for Small and Medium Enterprises. These credits represent a pivotal opportunity to invest in a greener future while simultaneously bolstering your company’s bottom line.

The Dawn of a New Era: Understanding the 2026 Clean Energy Tax Credits

The year 2026 marks a significant step forward in federal commitment to clean energy and sustainable practices for businesses across the United States. These updated tax credits are not merely a continuation of previous incentives; they represent a refined, expanded, and more accessible framework designed to accelerate the adoption of renewable energy technologies and energy-efficient solutions within the SME sector. The goal is clear: to empower smaller businesses to play a larger role in the nation’s energy transition, fostering both economic growth and environmental stewardship.

This initiative builds upon earlier legislative efforts, but with a renewed focus on streamlining the application process and broadening the scope of eligible activities. Many businesses previously found the requirements daunting or the benefits too marginal. The 2026 revisions aim to dismantle these barriers, making clean energy investments a more attractive and straightforward proposition for a wider range of SMEs. It’s an opportunity for businesses to not only reduce operational costs but also to enhance their public image and contribute meaningfully to climate goals.

Key Legislative Changes and Their Impact

The legislative foundation for the 2026 credits introduces several critical changes. These include enhanced credit percentages for specific technologies, new eligibility pathways for certain industries, and simplified reporting requirements. The impact is expected to be widespread, encouraging everything from solar panel installations to electric vehicle fleet conversions.

- Increased credit percentages for solar and wind energy projects.

- New incentives for energy storage solutions and advanced grid technologies.

- Expanded definitions of eligible energy-efficient equipment.

- Simplified application processes for small businesses.

In essence, the 2026 Clean Energy Business Tax Credits are a powerful financial tool. They are designed to lower the upfront costs of clean energy investments, thereby improving the return on investment for businesses committed to sustainability. Understanding these changes is the first step toward leveraging them effectively for your enterprise.

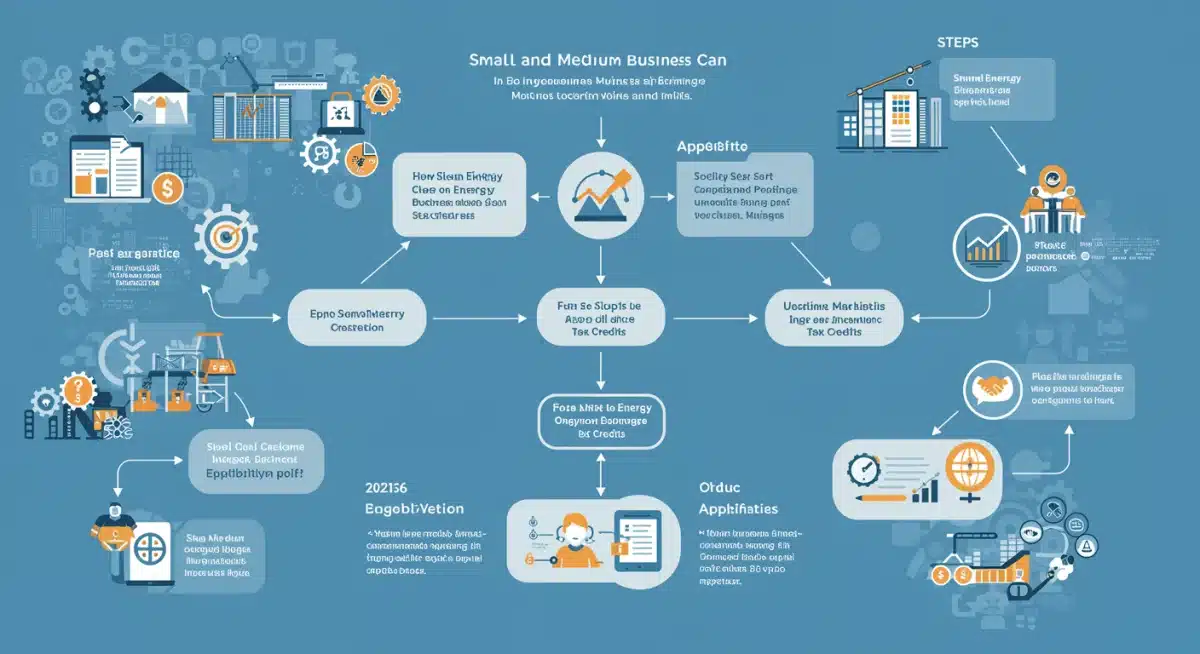

Eligibility and Application: Navigating the Path to Clean Energy Benefits

Understanding who qualifies for the 2026 Clean Energy Business Tax Credits and how to apply is paramount for SMEs seeking to capitalize on these incentives. While the overarching goal is broad participation, specific criteria ensure that the credits are directed towards projects that genuinely advance clean energy objectives. Eligibility often hinges on factors such as the type of clean energy technology being installed, its capacity, and the business’s operational structure.

The application process, though simplified compared to previous iterations, still requires careful attention to detail. Businesses will typically need to submit documentation proving their investment in eligible technologies, along with certifications that the equipment meets specified efficiency or performance standards. Consulting with tax professionals or energy consultants specializing in these credits can significantly streamline the process and minimize potential pitfalls.

Common Eligibility Criteria for SMEs

Most clean energy tax credits 2026 are structured to support a range of activities. Businesses should review the official IRS guidelines, but generally, the following criteria are common:

- Investment in renewable energy generation (e.g., solar, wind, geothermal).

- Adoption of energy-efficient building upgrades (e.g., HVAC, insulation, lighting).

- Purchase of qualified clean vehicles or charging infrastructure.

- Participation in specific clean manufacturing or production processes.

It is important to note that some credits may have specific thresholds or caps, and businesses should verify these details based on their projected investments. Proper record-keeping from the outset of any clean energy project will be essential for a smooth application and audit process.

The path to claiming these credits involves careful planning and execution. Businesses should begin by assessing their energy consumption and identifying areas where clean energy investments can yield the greatest impact, both environmentally and financially. This initial assessment can then inform the selection of eligible technologies and the subsequent application for credits, ensuring maximum benefit.

Maximizing Your Returns: Strategic Planning for Tax Credit Utilization

Simply qualifying for the 2026 Clean Energy Business Tax Credits is only half the battle; strategically utilizing them to maximize your returns requires careful planning and foresight. These credits are not a one-size-fits-all solution, and their optimal application will vary depending on the specific financial situation and long-term goals of each SME. Understanding how to integrate these credits into your overall financial strategy can unlock significant long-term value, beyond just the immediate tax reduction.

One key aspect of strategic utilization involves combining these federal credits with state and local incentives. Many states and municipalities offer their own programs to encourage clean energy adoption, and stacking these benefits can dramatically improve the financial viability of projects. Furthermore, businesses should consider the depreciation benefits associated with clean energy assets, which can further reduce taxable income over time.

Bundling Incentives for Greater Impact

Combining various incentives is a powerful strategy. For instance, a business installing solar panels might be eligible for federal tax credits, state-level rebates, and local property tax exemptions. This synergistic approach significantly lowers the net cost of the investment.

- Research state and local clean energy programs.

- Consult with financial advisors experienced in energy tax incentives.

- Evaluate the long-term operational savings from reduced energy consumption.

- Consider the public relations benefits of visible sustainability efforts.

Moreover, businesses should look beyond the immediate tax savings and consider the broader financial implications. Reduced energy bills, increased property value, and improved brand perception all contribute to a stronger financial position. Strategic planning ensures that every dollar invested in clean energy yields multiple returns.

Beyond the Credits: Long-Term Financial Advantages of Clean Energy Adoption

While the 2026 Clean Energy Business Tax Credits offer compelling immediate financial incentives, the true value of adopting clean energy solutions extends far beyond these initial reductions. SMEs that invest in sustainable practices position themselves for a range of long-term financial advantages that can enhance profitability, reduce operational risks, and foster sustained growth. These benefits often accrue incrementally, building a stronger, more resilient business model over time.

One of the most direct and enduring advantages is the significant reduction in operational costs. By generating their own power or drastically improving energy efficiency, businesses become less vulnerable to fluctuating energy prices and can achieve predictable utility expenses. This stability is a considerable asset in a volatile economic environment, allowing for more accurate budgeting and improved cash flow management. Furthermore, many clean energy systems require less maintenance than traditional alternatives, further trimming operating expenses.

Operational Savings and Market Positioning

The switch to clean energy translates into tangible savings and improved market standing. Businesses that embrace sustainability often find themselves more attractive to environmentally conscious consumers and investors.

- Reduced utility bills through self-generated power or enhanced efficiency.

- Protection against future energy price volatility.

- Lower maintenance costs for modern clean energy systems.

- Enhanced brand reputation and appeal to green consumers.

Beyond direct financial savings, clean energy adoption also improves a company’s market positioning. Consumers and business partners increasingly prioritize sustainability, making eco-friendly practices a competitive advantage. Companies that visibly commit to clean energy can attract new customers, retain existing ones, and even recruit top talent who are drawn to socially responsible organizations. These intangible benefits often translate into tangible financial gains over the long haul.

Case Studies: Real-World Success with Clean Energy Investments

The theory behind clean energy tax credits 2026 is compelling, but real-world examples truly illustrate their transformative power. Across the United States, numerous Small and Medium Enterprises have already begun leveraging similar incentives, demonstrating the tangible benefits of investing in clean energy. These case studies provide valuable insights into the practical application of tax credits and the diverse ways businesses can achieve both environmental and financial success.

Consider a small manufacturing plant in the Midwest that installed a rooftop solar array. Initially hesitant due to upfront costs, the availability of federal and state tax credits, combined with accelerated depreciation, made the project financially viable. Within five years, the plant significantly reduced its electricity bills, achieving energy independence for a substantial portion of its operations. This not only improved its profit margins but also insulated it from rising energy costs, providing a competitive edge.

Diverse Applications, Universal Benefits

From retail to agriculture, clean energy investments are proving beneficial across various sectors. These examples highlight the adaptability and widespread applicability of the tax credit programs.

- A local bakery upgraded to energy-efficient ovens and HVAC systems, reducing its carbon footprint and operational expenses by 20%.

- A small logistics company transitioned a portion of its fleet to electric vehicles, utilizing credits for EV purchases and charging infrastructure, leading to lower fuel and maintenance costs.

- An agricultural enterprise implemented geothermal heating for its greenhouses, benefiting from substantial installation credits and year-round energy savings.

These examples underscore a crucial point: clean energy adoption is not limited to specific industries. Any SME, regardless of its sector, can find pathways to benefit from these incentives. The key is identifying the most suitable technologies for their unique operational needs and strategically leveraging the available financial support.

The Future is Green: Preparing Your SME for Sustainable Growth

Looking ahead, the commitment to clean energy is not merely a passing trend but a fundamental shift in how businesses operate. For Small and Medium Enterprises, preparing for this sustainable future means more than just taking advantage of the 2026 Clean Energy Business Tax Credits; it involves embedding sustainability into the core of their business strategy. This proactive approach ensures long-term resilience, fosters innovation, and positions companies as leaders in an increasingly eco-conscious market.

The incentives available in 2026 are a clear signal from policymakers about the direction of the economy. Businesses that align themselves with this vision stand to gain not only financial benefits but also a competitive advantage. This includes investing in employee training for green technologies, exploring sustainable supply chain practices, and continuously seeking out new energy-efficient solutions. The future rewards those who are prepared to adapt and innovate.

Embracing Innovation and Continuous Improvement

Sustainable growth is an ongoing journey that requires a commitment to continuous improvement and embracing new technologies as they emerge. Staying informed about future legislative changes and technological advancements is vital.

- Develop a long-term sustainability roadmap for your business.

- Allocate resources for researching new clean energy technologies.

- Engage employees in sustainability initiatives and training.

- Monitor regulatory changes and future incentive programs.

Ultimately, the 2026 Clean Energy Business Tax Credits are a catalyst for change. They provide a powerful impetus for SMEs to embark on or accelerate their sustainability journeys. By taking a holistic view of clean energy adoption, businesses can secure not only immediate financial gains but also a robust and prosperous future in the green economy.

| Key Aspect | Brief Description |

|---|---|

| Eligibility | Criteria for SMEs investing in renewable energy, efficiency, and clean vehicles. |

| Application | Requires documentation of eligible investments and adherence to performance standards. |

| Maximizing Benefits | Combine federal credits with state/local incentives and depreciation benefits. |

| Long-Term Gains | Reduced operational costs, market advantage, and enhanced brand reputation. |

Frequently Asked Questions About 2026 Clean Energy Tax Credits

These are federal financial incentives designed to encourage Small and Medium Enterprises (SMEs) in the U.S. to invest in renewable energy technologies and energy-efficient solutions. They aim to reduce upfront costs and accelerate the transition to a greener economy.

Eligible investments commonly include solar panel installations, wind energy systems, geothermal heating and cooling, energy storage, efficient HVAC upgrades, and the purchase of electric vehicles or charging infrastructure for business use.

Application typically involves submitting relevant IRS forms with your tax return, providing documentation of eligible expenditures and system certifications. Consulting a tax professional specializing in clean energy incentives is highly recommended for accuracy.

Yes, many states and local governments offer complementary rebates, grants, or additional tax incentives for clean energy projects. Combining these can significantly enhance the overall financial benefits and project viability for SMEs.

Beyond the immediate tax savings, long-term benefits include reduced operational costs, increased energy independence, improved brand reputation, enhanced competitiveness, and a positive contribution to environmental sustainability, fostering resilient business growth.

Conclusion

The 2026 Clean Energy Business Tax Credits present an unparalleled opportunity for Small and Medium Enterprises across the United States. These incentives are more than just a temporary financial boost; they are a strategic pathway to sustainable growth, reduced operational costs, and an enhanced market position. By understanding the eligibility criteria, strategically planning their investments, and leveraging a combination of federal, state, and local programs, SMEs can significantly benefit. Embracing clean energy is not just about compliance or cost-cutting; it’s about future-proofing your business and contributing to a healthier planet. The time for SMEs to act on these powerful incentives is now, paving the way for a more resilient and environmentally responsible economic landscape.