IRA: 3 Clean Energy Benefits to Claim Before December 2025

The Inflation Reduction Act provides substantial clean energy benefits, notably residential clean energy credits, energy-efficient home improvement credits, and electric vehicle tax credits, all of which homeowners and consumers should claim before the December 2025 deadline.

The landscape of clean energy in the United States is undergoing a transformative shift, largely propelled by the landmark legislation known as the Inflation Reduction Act (IRA). For homeowners and consumers, understanding The Inflation Reduction Act: 3 Key Clean Energy Benefits You Must Claim Before December 2025 is not just about environmental stewardship, but also about significant financial savings. This act has opened doors to unprecedented incentives, making sustainable living more accessible and affordable than ever before. As we approach the critical deadline of December 2025, it’s essential to grasp these opportunities to maximize your benefits and contribute to a greener future.

Understanding the Inflation Reduction Act’s Clean Energy Vision

The Inflation Reduction Act (IRA), signed into law in August 2022, represents the most significant climate legislation in U.S. history. Its overarching goal is to combat inflation by reducing the federal deficit, lowering prescription drug costs, and, crucially, investing heavily in domestic clean energy and climate programs. For individuals and families, this means a wealth of incentives designed to make clean energy solutions more affordable and widespread.

This ambitious act aims to accelerate the transition to a clean energy economy, reduce greenhouse gas emissions by 40% below 2005 levels by 2030, and create millions of good-paying jobs. It does so through a combination of tax credits, rebates, and grants, targeting everything from renewable energy generation to electric vehicle adoption and home energy efficiency upgrades. The financial benefits are substantial, offering a clear pathway for Americans to reduce their carbon footprint while simultaneously saving money on energy costs.

The IRA’s impact extends beyond individual benefits, fostering a robust domestic clean energy industry. By incentivizing manufacturing and deployment of clean technologies within the U.S., the act aims to strengthen energy independence, create resilient supply chains, and ensure that the economic benefits of the green transition are widely shared. This comprehensive approach underscores the government’s commitment to a sustainable and prosperous future, with a clear focus on empowering consumers to be part of this change.

In essence, the Inflation Reduction Act is a pivotal moment for clean energy. It provides a strategic framework and the necessary financial impetus to accelerate the adoption of sustainable practices across the nation. For those looking to invest in cleaner energy solutions, understanding these provisions is the first step towards unlocking significant long-term value and contributing to a healthier planet.

Benefit 1: Residential Clean Energy Credit (Solar, Wind, Geothermal)

One of the most impactful provisions of the Inflation Reduction Act for homeowners is the Residential Clean Energy Credit, often referred to as the solar tax credit. This credit offers a substantial incentive for installing renewable energy systems in your home, directly reducing your federal tax liability. It’s designed to make technologies like solar panels, wind turbines, and geothermal heat pumps more accessible and affordable for the average American household.

The Residential Clean Energy Credit provides a 30% tax credit for the cost of new, qualified clean energy property for your home. This credit is non-refundable, meaning it can reduce your tax bill to zero, and any unused portion can be carried forward to future tax years. This makes it an incredibly powerful tool for offsetting the initial investment in these systems, which can be significant. The 30% rate is locked in until 2032, after which it begins to phase down, making the period before December 2025 a prime time to act.

Eligible Clean Energy Systems

The credit covers a broad range of technologies aimed at generating clean energy on your property. Understanding what qualifies is crucial for planning your home improvements.

- Solar Electric Property: This includes solar panels installed to generate electricity for your home. Both purchased systems and those financed through solar loans typically qualify.

- Solar Water Heating Property: Systems that use solar energy to heat water for your home. It’s important that at least half of the energy used to heat water comes from solar.

- Geothermal Heat Pumps: These systems use the earth’s stable temperature to heat and cool your home efficiently. They offer significant energy savings compared to traditional HVAC systems.

- Small Wind Energy Property: Wind turbines installed on your property to generate electricity.

- Fuel Cell Property: Systems that convert fuel into electricity and heat through an electrochemical process.

- Battery Storage Technology: For systems installed after 2022, battery storage with a capacity of at least 3 kWh is also eligible, allowing homeowners to store excess renewable energy for later use or during power outages.

Claiming this credit involves filing IRS Form 5695, Residential Clean Energy Credit, with your tax return. It’s essential to keep detailed records of all expenses related to the purchase and installation of your system, including equipment costs, labor, and necessary permits. Consulting with a tax professional can help ensure you maximize this benefit and navigate any complexities.

The opportunity to claim a 30% tax credit on these significant investments makes renewable energy solutions more attainable for many. By taking advantage of this credit before the December 2025 window, homeowners can drastically reduce their upfront costs, leading to faster payback periods and long-term savings on energy bills. This benefit is a cornerstone of the IRA’s strategy to empower individual contributions to a sustainable energy future.

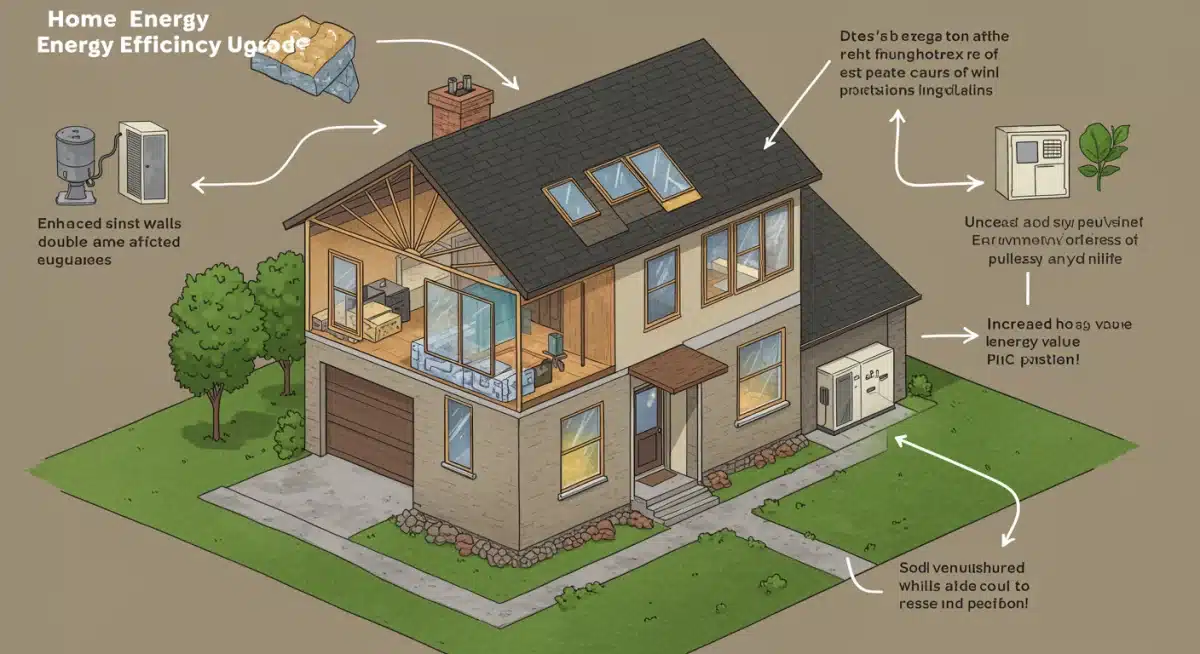

Benefit 2: Energy Efficient Home Improvement Credit

Beyond generating your own clean energy, the Inflation Reduction Act also provides substantial incentives for making your home more energy-efficient. The Energy Efficient Home Improvement Credit, formerly known as the Nonbusiness Energy Property Credit, has been significantly enhanced under the IRA. This credit helps homeowners offset the costs of upgrades that reduce energy consumption and improve the overall efficiency of their residences, making homes more comfortable and less expensive to operate.

This credit offers a tax credit equal to 30% of the costs of eligible home improvements, up to a maximum of $1,200 annually for most upgrades, and up to $2,000 annually for heat pumps, biomass stoves, or biomass boilers. This annual limit is a key improvement, allowing homeowners to claim the credit year after year for different qualifying improvements. This structure encourages a more gradual, but consistent, approach to home energy upgrades, rather than a one-time renovation.

Qualifying Home Improvements

The range of eligible improvements is broad, covering many common household upgrades designed to boost energy performance. Understanding these categories can help you plan your renovations strategically.

- Insulation and Air Sealing Materials: This includes adding insulation to attics, walls, floors, and crawl spaces, as well as sealing air leaks around windows, doors, and other penetrations.

- Exterior Doors and Windows: Energy-efficient exterior doors and windows, including skylights, that meet specific Energy Star requirements.

- Central Air Conditioners, Furnaces, and Water Heaters: Highly efficient models, including natural gas, propane, or oil furnaces and water heaters, that meet or exceed specific energy efficiency standards.

- Heat Pumps and Biomass Stoves/Boilers: Electric or natural gas heat pump water heaters, electric or natural gas heat pumps, and biomass fuel stoves and boilers. These items have a higher annual credit limit of $2,000.

- Energy Audits: The cost of a home energy audit, up to $150, is also eligible, helping homeowners identify the most impactful upgrades for their specific property.

To claim this credit, you’ll need to use IRS Form 5695, Residential Clean Energy Credit, similar to the residential clean energy credit. It’s crucial to obtain manufacturer certifications that the products you purchase qualify for the credit. Keeping detailed records of purchases and installation costs is always recommended. This credit is available through 2032, but acting before December 2025 ensures you can take full advantage of current market conditions and product availability.

Investing in energy-efficient home improvements not only reduces your carbon footprint but also leads to noticeable savings on your monthly utility bills. The enhanced Energy Efficient Home Improvement Credit makes these upgrades more financially appealing, allowing homeowners to create a more comfortable, sustainable, and cost-effective living environment. Don’t miss the chance to leverage these benefits before the 2025 deadline to make your home a beacon of energy efficiency.

Benefit 3: Clean Vehicle Tax Credits

The Inflation Reduction Act significantly reshaped and expanded the tax credits available for purchasing new and used clean vehicles, including electric vehicles (EVs) and fuel cell vehicles (FCVs). This initiative is a cornerstone of the IRA’s strategy to accelerate the adoption of zero-emission transportation, reduce reliance on fossil fuels, and lower transportation costs for consumers. These credits are designed to make clean vehicles more competitive with gasoline-powered cars, addressing a key barrier to widespread adoption: upfront cost.

For new clean vehicles, a credit of up to $7,500 is available, while used clean vehicles can qualify for a credit of up to $4,000. However, these credits come with several important requirements concerning vehicle manufacturing, battery components, and consumer income levels. These criteria are designed to promote domestic manufacturing, strengthen supply chains, and ensure the benefits are accessible to a broad range of income earners.

New Clean Vehicle Credit Requirements

To qualify for the New Clean Vehicle Credit, several conditions must be met:

- Vehicle Manufacturing: The vehicle must have undergone final assembly in North America. This requirement aims to bolster domestic manufacturing and job creation.

- Battery Component Sourcing: A certain percentage of the battery components must be manufactured or assembled in North America. This percentage increases over time.

- Critical Mineral Sourcing: A certain percentage of the critical minerals used in the battery must be extracted or processed in the U.S. or a country with which the U.S. has a free trade agreement, or be recycled in North America. This percentage also increases over time.

- MSRP Limits: The manufacturer’s suggested retail price (MSRP) cannot exceed $80,000 for vans, SUVs, and pickup trucks, or $55,000 for other vehicles.

- Income Limitations: The buyer’s modified adjusted gross income (MAGI) cannot exceed $300,000 for joint filers, $225,000 for heads of household, or $150,000 for all other filers.

Used Clean Vehicle Credit Requirements

The Used Clean Vehicle Credit offers an incentive for pre-owned EVs and FCVs, making them more affordable. Key requirements include:

- Sale Price Limit: The sale price must be $25,000 or less.

- Dealer Sale: The vehicle must be purchased from a dealer.

- Age Requirement: The vehicle must be at least two model years older than the calendar year in which it is purchased.

- Buyer Income Limitations: The buyer’s MAGI cannot exceed $150,000 for joint filers, $112,500 for heads of household, or $75,000 for all other filers.

These credits can be applied at the point of sale by dealers registered with the IRS, allowing consumers to receive the benefit immediately as a reduction in the purchase price. This direct application of the credit is a significant convenience. Given the evolving nature of vehicle eligibility and the December 2025 timeframe, staying informed about the latest IRS guidance and manufacturer certifications is crucial. Taking advantage of these credits can lead to substantial savings, making the transition to a clean vehicle a financially astute decision.

Strategic Planning to Maximize IRA Benefits Before 2025

The time-sensitive nature of some of the Inflation Reduction Act’s benefits, particularly with the December 2025 horizon for certain provisions, necessitates a strategic approach. Maximizing these clean energy incentives requires careful planning, research, and often, professional guidance. Rushing into decisions without a clear understanding of the eligibility criteria and application processes can lead to missed opportunities or sub-optimal outcomes. Therefore, a well-thought-out strategy is paramount for homeowners and consumers.

One of the first steps in strategic planning is to conduct a thorough assessment of your current energy consumption and potential for clean energy upgrades. This could involve a home energy audit, reviewing your utility bills, and evaluating your transportation needs. Understanding where you stand will help you prioritize which IRA benefits are most relevant and impactful for your specific situation. For instance, a household with high electricity bills might prioritize solar installation, while an older home could benefit most from comprehensive insulation upgrades.

Key Planning Considerations

To effectively leverage the IRA’s clean energy benefits, consider the following:

- Timeline Awareness: Understand the phase-down schedules for the tax credits. While many extend beyond 2025, the 30% rate for the Residential Clean Energy Credit is stable until 2032, making current action highly advantageous.

- Product Eligibility: Ensure that any products or systems you plan to purchase meet the specific IRS and DOE requirements. This includes Energy Star ratings, North American manufacturing for EVs, and specific efficiency standards for appliances.

- Financial Readiness: While the credits reduce costs, there’s still an upfront investment. Assess your financial capacity and explore financing options, such as low-interest loans for energy efficiency upgrades, which can further enhance the affordability.

- Professional Consultation: Engage with qualified contractors, energy auditors, and tax professionals. They can provide expert advice on eligible projects, ensure proper installation, and help navigate the complexities of claiming the credits accurately on your tax returns.

The period leading up to December 2025 offers a unique window to make significant strides in your personal clean energy transition. By adopting a proactive and informed approach, you can ensure that you not only claim all eligible benefits but also make choices that provide lasting environmental and financial advantages. This strategic planning is crucial for unlocking the full potential of The Inflation Reduction Act: 3 Key Clean Energy Benefits You Must Claim Before December 2025.

Navigating the Application Process and Documentation

Successfully claiming the clean energy benefits offered by the Inflation Reduction Act requires diligent navigation of the application process and meticulous documentation. While the benefits are substantial, the IRS has specific requirements to ensure compliance and prevent fraud. Understanding these steps and preparing thoroughly can streamline the process and help you avoid common pitfalls, ensuring you receive the full extent of the credits you are entitled to.

For most individual tax credits, the primary mechanism for claiming benefits is through your annual federal income tax return. This typically involves completing specific IRS forms and attaching them to your Form 1040. The most common form for residential energy credits is Form 5695, Residential Clean Energy Credit, which covers both the Residential Clean Energy Credit and the Energy Efficient Home Improvement Credit. For clean vehicle credits, the process might involve a point-of-sale reduction or a credit claimed on your tax return, depending on the specific circumstances and dealer registration.

Essential Documentation for Claiming Credits

Proper documentation is the bedrock of a successful credit claim. Without it, the IRS may deny your claim. Here’s a breakdown of what you’ll typically need:

- Purchase Receipts and Invoices: Keep detailed receipts for all eligible equipment and materials purchased. Invoices should clearly itemize costs and services, including installation labor.

- Manufacturer’s Certification Statements: Many eligible products, especially for the Energy Efficient Home Improvement Credit, require a manufacturer’s certification that the product meets the specific energy efficiency standards set by the IRS or Department of Energy.

- Installation Contracts: If you hired a contractor for installation, retain copies of all contracts, which should detail the scope of work and costs.

- Vehicle Purchase Agreements: For clean vehicle credits, hold onto your vehicle purchase agreement, which should include the VIN, purchase price, and dealer information.

- Proof of System Operation (for some): In some cases, particularly for larger renewable energy systems, documentation of the system’s operational status might be useful.

It is highly recommended to keep all these documents organized in a dedicated folder or digital file. This will simplify the process when you or your tax professional prepare your tax return. Remember that the IRS can audit tax returns for up to three years after filing, so maintaining accurate records is crucial for future reference.

For the clean vehicle credit, specifically, if you’re taking advantage of the point-of-sale transfer, the dealer will handle much of the immediate paperwork. However, you will still need to ensure that the dealer provides you with the necessary documentation for your records and for potential verification by the IRS. Proactive engagement with your tax advisor and a meticulous approach to record-keeping will ensure a smooth process as you claim the valuable benefits offered by the IRA.

The Broader Impact of Clean Energy Benefits on Your Future

While the immediate financial incentives of The Inflation Reduction Act: 3 Key Clean Energy Benefits You Must Claim Before December 2025 are compelling, the broader impact of adopting clean energy solutions extends far beyond your tax return. Embracing these benefits is an investment in your financial future, your home’s value, and the health of the planet. The decisions made by consumers in the coming years will collectively shape the trajectory of the nation’s energy landscape and contribute to a more sustainable future for generations to come.

Financially, transitioning to clean energy sources and improving home energy efficiency leads to long-term savings on utility bills. Imagine significantly reduced or even eliminated electricity costs through solar power, or lower heating and cooling expenses thanks to improved insulation and efficient HVAC systems. These recurring savings free up household income that can be redirected to other financial goals or simply improve your overall quality of life. Furthermore, clean vehicles dramatically reduce fuel costs and often require less maintenance, adding to the long-term financial benefits.

Beyond direct savings, investing in clean energy can significantly increase your property value. Homes equipped with solar panels, high-efficiency appliances, and EV charging stations are increasingly attractive to buyers who are conscious of energy costs and environmental impact. As energy prices fluctuate and climate concerns grow, a home with a lower carbon footprint and reduced operating expenses becomes a highly desirable asset in the real estate market. This can translate into a higher resale value and a quicker sale when the time comes.

Sustainable Living and Community Benefits

The impact of individual actions, when aggregated, fosters significant community and environmental benefits:

- Reduced Carbon Footprint: By choosing clean energy, you directly contribute to lowering greenhouse gas emissions, helping to mitigate climate change and improve air quality.

- Energy Independence: Relying less on fossil fuels and more on domestic renewable sources strengthens national energy security and reduces vulnerability to global energy market fluctuations.

- Job Creation: The growth of the clean energy sector, spurred by the IRA, creates numerous jobs in manufacturing, installation, and maintenance, boosting local economies.

- Technological Advancement: Increased demand for clean energy solutions drives innovation, leading to even more efficient and affordable technologies in the future.

The window until December 2025 represents a golden opportunity to not only personally benefit from these incentives but also to be a part of a larger movement towards a sustainable future. By making informed choices now, you can secure financial advantages, enhance your property’s value, and play a crucial role in building a cleaner, more resilient energy system for the United States. This is more than just claiming a tax credit; it’s about investing in a better tomorrow.

| Key Benefit | Brief Description |

|---|---|

| Residential Clean Energy Credit | 30% tax credit for installing solar, wind, or geothermal systems. No cap, carryforward allowed. |

| Energy Efficient Home Improvement Credit | 30% tax credit for eligible home efficiency upgrades, up to $1,200 annually ($2,000 for heat pumps). |

| Clean Vehicle Tax Credits | Up to $7,500 for new and $4,000 for used clean vehicles, subject to strict manufacturing and income limits. |

| Claim Deadline Urgency | While some credits extend, acting before December 2025 ensures maximum current benefits and avoids potential future changes. |

Frequently Asked Questions About IRA Clean Energy Benefits

While some provisions of the Inflation Reduction Act extend beyond 2025, it’s crucial to understand that the current beneficial rates and specific eligibility criteria are subject to change. Acting before December 2025 ensures you can capitalize on the most favorable terms for residential clean energy, home improvements, and vehicle credits before any potential phase-downs or modifications occur.

Yes, you can often claim multiple clean energy credits in the same tax year, provided you meet the specific eligibility requirements for each. For example, you could claim the Residential Clean Energy Credit for solar panel installation and the Energy Efficient Home Improvement Credit for new windows. However, certain limits apply, especially for the annual caps on home improvement credits.

No, the clean vehicle tax credits have strict requirements. For new vehicles, eligibility depends on factors like final assembly location in North America, battery component sourcing, critical mineral sourcing, MSRP limits, and buyer income. Used vehicles also have price, dealer, age, and income limitations. Always check the latest IRS guidance and manufacturer lists for qualifying vehicles.

It’s essential to keep meticulous records. This includes purchase receipts, invoices for equipment and installation labor, manufacturer’s certification statements for eligible products, and any contracts with installers. For clean vehicles, retain your purchase agreement. These documents are vital for accurately filing your tax return and for any potential IRS inquiries.

By incentivizing the adoption of renewable energy, energy-efficient home upgrades, and electric vehicles, these IRA benefits directly reduce greenhouse gas emissions and reliance on fossil fuels. This contributes to mitigating climate change, improving air quality, and fostering energy independence. Individual actions collectively drive significant environmental progress and support the growth of a green economy.

Conclusion

The Inflation Reduction Act presents a pivotal moment for individuals to embrace clean energy, offering substantial financial incentives that are designed to make sustainable living more accessible than ever. By focusing on The Inflation Reduction Act: 3 Key Clean Energy Benefits You Must Claim Before December 2025 – namely, the Residential Clean Energy Credit, the Energy Efficient Home Improvement Credit, and the Clean Vehicle Tax Credits – homeowners and consumers have a clear pathway to significant savings. Acting strategically and understanding the nuances of eligibility and documentation are crucial for maximizing these opportunities. Beyond the immediate financial gains, leveraging these benefits contributes to a more sustainable future, enhances property value, and fosters a robust clean energy economy. Don’t let this limited-time opportunity pass by; prepare now to secure your share of these transformative clean energy benefits.