Power Purchase Agreements 2025: Reduce Energy Costs by 10%

Power Purchase Agreements (PPAs) in 2025 represent a crucial financial instrument enabling businesses to achieve substantial energy cost reductions, typically around 10%, through stable, long-term contracts for renewable energy procurement.

Are you looking to significantly lower your operational expenses while championing sustainability? Understanding Power Purchase Agreements (PPAs) in 2025: A Financial Guide to Reducing Energy Costs by 10% (PRACTICAL SOLUTIONS, FINANCIAL IMPACT) is essential for any business aiming to stabilize budgets and embrace clean energy. This guide will demystify PPAs, offering practical solutions and highlighting their profound financial impact on your bottom line.

The evolving landscape of energy procurement in 2025

The energy market is undergoing a profound transformation, driven by technological advancements, regulatory shifts, and a growing corporate commitment to sustainability. In 2025, businesses face mounting pressure to manage volatile energy prices while simultaneously reducing their carbon footprint. This dynamic environment necessitates innovative approaches to energy procurement, with Power Purchase Agreements (PPAs) emerging as a leading solution.

Traditional energy purchasing methods often leave companies exposed to market fluctuations, making long-term financial planning challenging. The unpredictable nature of fossil fuel prices, coupled with increasing demand for cleaner energy sources, has paved the way for renewable energy solutions like solar and wind power to become more financially viable and attractive. PPAs capitalize on this shift, offering a structured framework for securing renewable energy.

Key drivers for PPA adoption

- Energy price volatility: PPAs offer price certainty, protecting businesses from unpredictable market swings.

- Sustainability goals: Aligning with corporate social responsibility initiatives and reducing greenhouse gas emissions.

- Technological advancements: Decreasing costs and increased efficiency of renewable energy technologies make PPAs more competitive.

- Regulatory support: Government incentives and policies promoting clean energy further encourage PPA utilization.

The evolving landscape demands a proactive strategy for energy management. Businesses that embrace PPAs are not only securing their energy future but also positioning themselves as leaders in the transition to a sustainable economy. This forward-thinking approach can yield significant financial benefits and enhance brand reputation.

What exactly are Power Purchase Agreements (PPAs)?

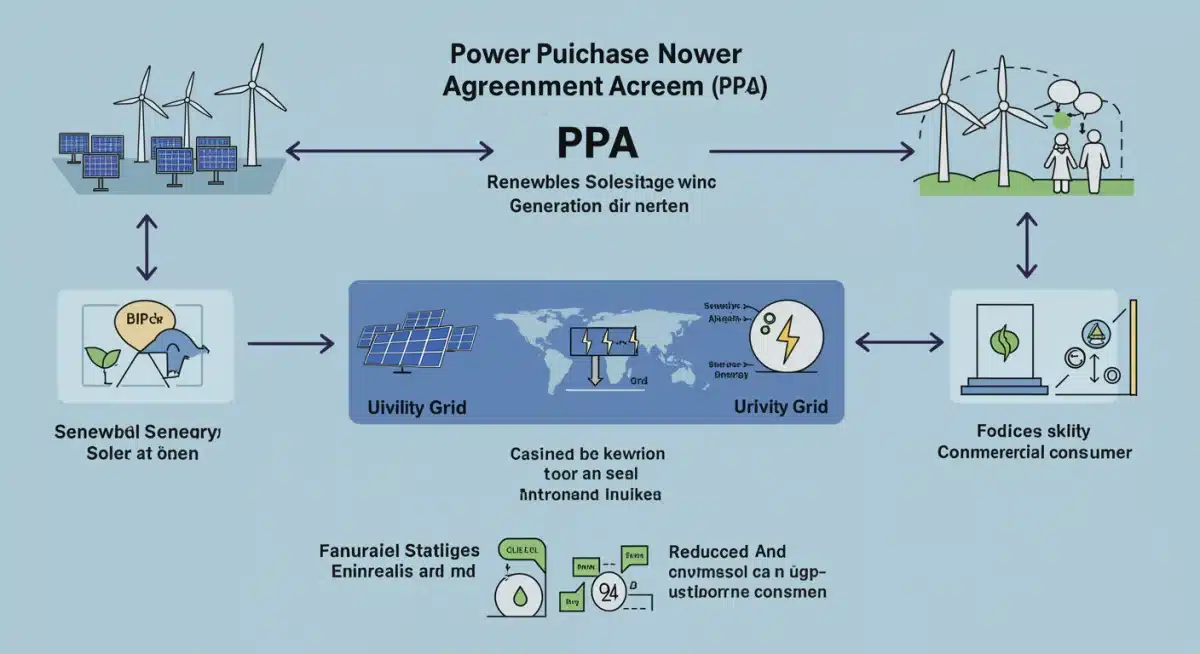

A Power Purchase Agreement (PPA) is a legal contract between two parties, where one party (the energy buyer, typically a business or organization) agrees to purchase electricity generated by an energy producer (often a renewable energy developer) at a predetermined price for a specified term. This term can range from 10 to 25 years or even longer, providing long-term price stability.

PPAs are fundamental to financing and developing renewable energy projects, as they guarantee a revenue stream for the energy producer, making it easier for them to secure project funding. For the energy buyer, PPAs offer a predictable energy cost, often lower than prevailing utility rates, without requiring upfront capital investment in renewable energy infrastructure.

Types of PPAs and their structures

- Physical PPA (Sleeve PPA): The energy producer delivers electricity directly to the buyer’s local utility grid, and the utility then delivers it to the buyer. This involves a physical flow of energy and often requires coordination with the local utility.

- Virtual PPA (Financial PPA): This is a purely financial contract where no physical electricity changes hands directly between the producer and buyer. The producer sells power to the wholesale market, and the buyer pays a fixed price to the producer. If the market price is higher, the producer pays the buyer the difference; if lower, the buyer pays the producer the difference, effectively hedging against market price volatility.

- On-site PPA: The renewable energy system (e.g., solar panels) is installed directly on the buyer’s property. The developer owns, operates, and maintains the system, selling the generated electricity to the host at a fixed rate.

Understanding these different structures is crucial for businesses to select the PPA that best aligns with their operational needs, risk tolerance, and sustainability objectives. Each type offers distinct advantages and considerations regarding energy delivery, financial hedging, and carbon accounting.

Ultimately, PPAs are designed to create a mutually beneficial relationship. The energy producer gains financial security for their project, while the energy buyer secures clean, cost-effective energy with price certainty for decades to come, contributing significantly to their economic and environmental goals.

Achieving 10% energy cost reduction through PPAs

One of the most compelling reasons for businesses to consider a PPA in 2025 is its proven ability to deliver significant energy cost reductions. Many companies report savings of 10% or more on their electricity bills, making PPAs a powerful financial tool. This reduction is primarily achieved through price certainty and often a lower per-unit cost compared to traditional utility rates.

PPAs allow businesses to lock in a fixed or escalating price for electricity over the contract term, shielding them from the unpredictable volatility of wholesale energy markets. This predictability enables more accurate budgeting and eliminates exposure to sudden price spikes that can severely impact operational expenses. The long-term nature of these agreements provides a stable financial foundation for energy procurement.

Mechanisms for cost savings

- Fixed pricing: Guarantees a stable electricity rate, insulating against market fluctuations.

- Lower per-unit cost: Renewable energy, once installed, often has lower marginal costs than fossil fuel generation, translating to competitive PPA rates.

- Avoidance of utility rate increases: PPAs bypass future utility rate hikes, providing long-term cost predictability.

- Tax incentives and credits: Developers often pass through a portion of renewable energy tax credits and incentives, further reducing the effective price of electricity.

The 10% (or greater) cost reduction is not merely an aspiration; it’s a tangible outcome for many businesses that strategically implement PPAs. This financial benefit, combined with the positive environmental impact, makes PPAs an increasingly attractive component of modern corporate financial strategies. Evaluating the potential savings requires a thorough analysis of current energy consumption patterns, local utility rates, and available PPA options.

Practical solutions: implementing a PPA for your business

Implementing a PPA requires careful planning and execution, but the process is becoming increasingly streamlined as the market matures. Businesses looking to adopt a PPA should begin with a comprehensive assessment of their energy needs, consumption profiles, and long-term financial objectives. This initial step is critical for identifying the most suitable PPA structure and potential partners.

Engaging with experienced energy consultants and legal advisors is highly recommended to navigate the complexities of PPA contracts. These professionals can help evaluate proposals, negotiate terms, and ensure compliance with local regulations. The selection of a reputable developer and a robust project is paramount to the long-term success of the PPA.

Steps for successful PPA implementation

- Assess energy needs: Analyze historical energy consumption and future projections to determine optimal PPA size and structure.

- Market research and RFI/RFP: Identify potential PPA providers and issue a Request for Information (RFI) or Request for Proposal (RFP) to gather competitive bids.

- Due diligence: Thoroughly vet potential developers, reviewing their track record, financial stability, and project portfolio.

- Contract negotiation: Work with legal and financial experts to negotiate favorable terms, including price, term length, performance guarantees, and termination clauses.

- Monitoring and management: Establish a robust system for monitoring energy generation and consumption, ensuring the PPA delivers expected benefits.

For on-site PPAs, considerations like roof structure, available land, and interconnection requirements with the local utility also play a significant role. Virtual PPAs, while not requiring physical installation on the premises, demand a strong understanding of financial hedging strategies. By following these practical steps, businesses can confidently implement a PPA that aligns with their financial and sustainability goals, ensuring a smooth transition to cleaner, more predictable energy.

Financial impact: beyond direct cost savings

While direct energy cost reduction is a primary driver for adopting PPAs, their financial impact extends far beyond immediate savings. PPAs can significantly enhance a company’s financial stability, improve its balance sheet, and even open new avenues for investment and growth. The predictable nature of PPA pricing aids in long-term financial forecasting, reducing budgetary uncertainties.

Furthermore, by committing to renewable energy through a PPA, businesses can bolster their environmental, social, and governance (ESG) credentials. Strong ESG performance is increasingly valued by investors, customers, and employees, potentially leading to lower capital costs, improved brand reputation, and enhanced talent attraction and retention. This indirect financial benefit is becoming an increasingly important consideration for publicly traded companies and those seeking to attract socially conscious investment.

Broader financial advantages

- Balance sheet optimization: Since the renewable energy system is typically owned by the developer, the PPA buyer avoids significant capital expenditure and associated debt.

- Hedge against inflation: Fixed PPA prices can act as a hedge against future energy price inflation, preserving purchasing power.

- Enhanced creditworthiness: Demonstrating a commitment to sustainable practices can improve a company’s credit rating.

- New revenue streams (for some PPAs): In certain PPA structures, excess power generation could potentially be sold back to the grid, though this is less common for standard buyer-side PPAs.

The financial ripple effect of a PPA can be transformative. It allows businesses to reallocate capital that would otherwise be tied up in energy infrastructure to core business activities or strategic growth initiatives. This strategic financial planning contributes to a more resilient and sustainable business model in the long run, proving that the benefits of PPAs are truly holistic.

Navigating challenges and risks in PPA agreements

While Power Purchase Agreements offer substantial benefits, it’s crucial for businesses to be aware of and proactively manage the inherent challenges and risks. A thorough understanding of these potential pitfalls can help mitigate negative impacts and ensure the PPA delivers on its promises. One significant challenge lies in the long-term nature of these contracts, which can extend for 15-25 years, making future market conditions difficult to predict.

Another area of concern can be the complexity of contract terms. PPAs are highly customized and involve intricate legal and financial clauses. Issues such as performance guarantees, force majeure events, termination clauses, and dispute resolution mechanisms must be carefully reviewed and negotiated. Engaging skilled legal counsel specialized in energy contracts is indispensable to protect the buyer’s interests.

Common risks and mitigation strategies

- Market price risk: If wholesale electricity prices drop significantly below the PPA rate, the buyer might pay more than the market rate. Mitigation includes careful price negotiation and incorporating market-responsive clauses.

- Production risk: The renewable energy system might underperform, generating less electricity than expected. Mitigation involves robust performance guarantees from the developer and liquidated damages clauses.

- Counterparty risk: The developer or energy producer might face financial difficulties or fail to uphold their obligations. Mitigation includes thorough due diligence on the developer’s financial health and reputation.

- Regulatory changes: Future changes in energy policy or regulations could impact the PPA’s economics. Mitigation involves including clauses that address regulatory shifts and ensuring legal expertise in relevant energy law.

Furthermore, for physical PPAs, grid interconnection issues or transmission constraints can pose challenges. Businesses must assess the reliability of the grid infrastructure and the feasibility of energy delivery to their facilities. By systematically identifying and addressing these challenges, companies can structure more resilient PPA agreements that maximize benefits while minimizing exposure to adverse outcomes.

The future of PPAs: trends and opportunities for 2025 and beyond

The landscape for Power Purchase Agreements is continuously evolving, with exciting trends and opportunities emerging for 2025 and the years to come. As renewable energy technologies become even more efficient and cost-effective, PPAs are expected to play an increasingly central role in global energy markets. The drive towards decarbonization, coupled with corporate sustainability mandates, will fuel further innovation and adoption.

One significant trend is the rise of aggregated PPAs, where multiple smaller energy buyers pool their demand to collectively procure renewable energy. This approach allows smaller and medium-sized enterprises (SMEs), which might not have the individual load to justify a large-scale PPA, to participate in the benefits of clean energy procurement. This democratization of PPAs opens new market segments and expands access to sustainable energy solutions.

Emerging trends and opportunities

- Storage-backed PPAs: Integration of battery storage with renewable energy projects to provide greater grid stability and allow for more flexible energy delivery, enhancing the value proposition of PPAs.

- Green hydrogen PPAs: As green hydrogen production scales, specialized PPAs for powering electrolyzers with renewable electricity are anticipated to grow.

- Increased corporate demand: More companies are setting ambitious 100% renewable energy targets, driving demand for innovative PPA structures.

- Digitalization and AI: Advanced analytics and artificial intelligence are being used to optimize PPA performance, predict energy generation, and manage market risks more effectively.

The future of PPAs is bright, characterized by greater flexibility, integration with other energy technologies, and broader accessibility. Businesses that stay abreast of these trends and proactively explore new PPA models will be best positioned to leverage these agreements for sustained financial advantage and leadership in the clean energy transition. The continuous innovation in the PPA market solidifies its role as a cornerstone of sustainable energy strategy.

| Key PPA Aspect | Brief Description |

|---|---|

| Cost Reduction | Lock in predictable rates, often 10% or more below traditional utility costs. |

| Financial Stability | Hedge against market volatility and gain long-term budget predictability. |

| Sustainability | Achieve ESG goals by sourcing energy from renewable projects. |

| Implementation | Requires careful assessment, due diligence, and expert negotiation of terms. |

Frequently asked questions about PPAs in 2025

The primary benefit of a PPA for businesses is the ability to lock in predictable, often lower, electricity rates for an extended period. This shields companies from market volatility and can lead to significant savings on energy costs over the contract term, typically 10-25 years.

No, one of the key advantages of PPAs is that they generally do not require any upfront capital investment from the energy buyer. The developer owns, operates, and maintains the renewable energy system, allowing the buyer to benefit from clean energy without the financial burden of ownership.

A physical PPA involves the direct delivery of electricity from the generator to the buyer (or via the utility). A virtual PPA, conversely, is a financial contract where no physical power changes hands directly between parties; it’s a hedge against market price fluctuations.

By entering into a PPA, a company directly supports the generation of renewable energy. This allows them to claim the environmental attributes of that energy, such as Renewable Energy Certificates (RECs), significantly reducing their carbon footprint and contributing to broader corporate sustainability objectives.

Main risks include market price volatility (if market prices drop below PPA rates), production risk (if the renewable asset underperforms), and counterparty risk (developer insolvency). Careful contract negotiation and due diligence are crucial for mitigating these potential challenges effectively.

Conclusion

Understanding Power Purchase Agreements (PPAs) in 2025 is more than just a financial exercise; it’s a strategic imperative for businesses seeking to thrive in a rapidly changing energy landscape. These agreements offer a robust pathway to significant energy cost reductions, often exceeding 10%, while simultaneously advancing corporate sustainability goals. By providing long-term price predictability and access to clean energy without upfront capital, PPAs empower organizations to build more resilient and environmentally responsible operations. As the market continues to innovate with solutions like aggregated and storage-backed PPAs, the opportunities for businesses to benefit will only grow. Embracing PPAs is not just about saving money today; it’s about securing a stable, sustainable, and financially sound energy future.