Geothermal Heating & Cooling: $8,000+ Federal Benefits for 2025 Installation

Homeowners in the US can access significant federal benefits, potentially exceeding $8,000, for installing geothermal heating and cooling systems in 2025, promoting sustainable energy solutions and reducing household costs.

Considering a significant upgrade to your home’s energy efficiency? The opportunity to install a geothermal heating and cooling system in 2025 comes with compelling financial advantages, particularly federal benefits that can exceed $8,000. This guide will navigate you through these incentives, ensuring you’re well-equipped to make an informed decision for a more sustainable and cost-effective home.

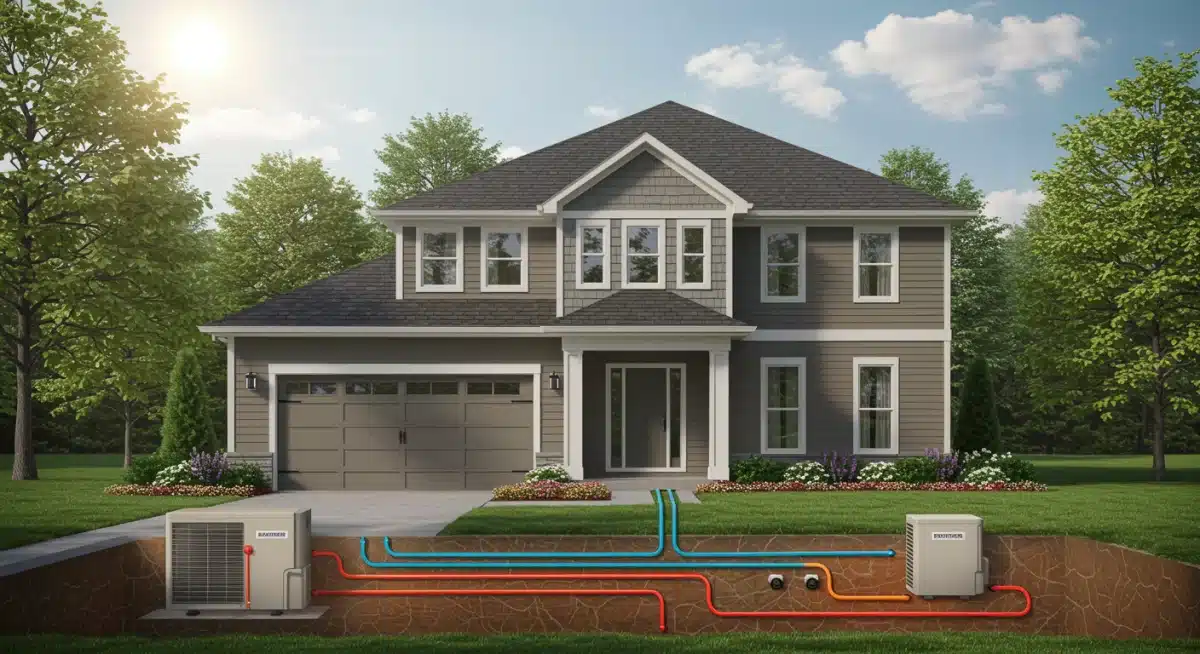

Understanding Geothermal Technology and Its Advantages

Geothermal heating and cooling systems harness the stable temperature of the earth to provide efficient climate control for your home. Unlike traditional HVAC systems that rely on burning fossil fuels or consuming significant electricity, geothermal systems simply transfer heat to and from the ground. This fundamental difference translates into substantial energy savings and reduced environmental impact.

The earth’s temperature just a few feet below the surface remains relatively constant year-round, typically between 45 and 75 degrees Fahrenheit, depending on your geographic location. Geothermal heat pumps leverage this consistency, extracting heat from the ground during colder months to warm your home and dissipating heat into the ground during warmer months for cooling. This process is remarkably efficient, often achieving efficiency ratings far superior to conventional systems.

How geothermal systems work

- Ground Loop Installation: A series of pipes, known as the ground loop, is buried underground, either horizontally or vertically, to exchange heat with the earth.

- Heat Transfer Fluid: A mixture of water and antifreeze circulates through these pipes, absorbing or releasing heat depending on the season.

- Heat Pump Unit: An indoor heat pump unit compresses and expands refrigerant to further concentrate or dissipate the heat, then distributes it throughout your home via ductwork.

Beyond the immediate comfort, opting for geothermal technology also positions your home for long-term value. These systems are known for their durability, often lasting 20-25 years for indoor components and over 50 years for the ground loop itself, significantly outlasting conventional HVAC units. This longevity, combined with lower operating costs, makes geothermal a wise investment for forward-thinking homeowners. Understanding these core principles is the first step toward appreciating the full scope of benefits, both financial and environmental.

The Inflation Reduction Act: A Game Changer for Geothermal

The Inflation Reduction Act (IRA) of 2022 fundamentally reshaped the landscape of clean energy incentives for American homeowners. Among its many provisions, the IRA significantly boosted the federal tax credit for residential clean energy products, making geothermal heating and cooling systems more accessible and affordable than ever before. This legislation is a cornerstone of the nation’s strategy to combat climate change, promote energy independence, and stimulate green job growth.

Prior to the IRA, the federal tax credit for geothermal installations was set to phase down. However, the IRA not only restored the credit to its previous high but also extended it for a substantial period, providing long-term certainty for homeowners planning these significant investments. This commitment from the federal government underscores the critical role geothermal technology plays in a sustainable energy future.

Key provisions of the IRA for geothermal

- 30% Tax Credit: The IRA extended the Residential Clean Energy Credit (formerly the Geothermal Heat Pump Tax Credit) at 30% of the installed cost for systems placed in service from 2022 through 2032.

- No Cap: Crucially, there is no maximum credit amount for geothermal systems, meaning the savings can be substantial for larger or more complex installations.

- Eligibility: The credit applies to new and existing homes located in the United States, covering the cost of the geothermal heat pump, installation labor, and all associated equipment.

The extension and enhancement of this tax credit are designed to accelerate the adoption of clean energy technologies like geothermal. For homeowners, this means a direct reduction in their federal income tax liability, effectively subsidizing a significant portion of the upfront cost. It’s a powerful incentive that transforms the financial feasibility of transitioning to a more efficient and environmentally friendly heating and cooling solution. The IRA’s impact cannot be overstated, as it provides a clear pathway for homeowners to invest in sustainable energy with robust federal support.

Maximizing Your Federal Tax Credit: What to Expect in 2025

For homeowners considering a geothermal system installation in 2025, understanding the nuances of the federal tax credit is paramount to maximizing your savings. The Residential Clean Energy Credit, as reinstated and extended by the Inflation Reduction Act, offers a substantial 30% credit on the total cost of your system. This isn’t a deduction; it’s a dollar-for-dollar reduction in your tax liability, making it an incredibly valuable incentive.

To fully leverage this benefit, it’s essential to keep accurate records of all expenses related to your geothermal installation. This includes the cost of the geothermal heat pump itself, any necessary ductwork modifications, excavation for the ground loop, labor costs, and any other components integral to the system’s operation. Every eligible dollar spent contributes to the 30% credit you can claim.

Calculating potential savings

- System Cost: If your geothermal system and installation cost $25,000, your federal tax credit would be $7,500.

- Higher Investments: For a more extensive system costing $30,000, the credit would reach $9,000.

- No Upper Limit: The absence of an upper limit means that even very large or complex installations can still benefit from the full 30% credit, significantly offsetting the initial investment.

It’s important to consult with a qualified tax professional to ensure you meet all eligibility requirements and correctly claim the credit when filing your federal income tax return. They can provide personalized advice based on your specific financial situation. Additionally, while the federal credit is a major draw, exploring state and local incentives, as well as utility rebates, can further amplify your savings. Combining these various programs can often push the total benefits well beyond the $8,000 mark, making geothermal an even more attractive proposition for homeowners committed to energy efficiency and long-term savings. The year 2025 presents a prime opportunity to capitalize on these robust federal incentives.

Beyond Federal: Exploring State, Local, and Utility Incentives

While the federal tax credit provides a significant financial boost for geothermal installations, it’s crucial for homeowners to recognize that this is often just one piece of a larger incentive puzzle. Many states, local municipalities, and even utility companies offer additional programs designed to encourage the adoption of renewable energy technologies. These supplementary incentives can dramatically reduce the net cost of a geothermal system, making the investment even more appealing.

These programs vary widely by location, reflecting regional energy policies, climate goals, and utility-specific initiatives. Some states might offer their own tax credits or rebates, while local governments could provide grants or property tax exemptions for homes with geothermal systems. Utility companies, keen to reduce demand on their grids and promote energy efficiency, frequently offer rebates for customers who install high-efficiency systems like geothermal heat pumps.

Types of additional incentives

- State Tax Credits: Many states offer their own income tax credits that can be combined with the federal credit, further reducing your tax liability.

- Local Rebates and Grants: Cities and counties sometimes have programs that provide direct financial assistance or grants for renewable energy installations.

- Utility Company Rebates: Electric and gas utilities often provide cash rebates to customers who install energy-efficient heating and cooling systems, including geothermal.

- Property Tax Exemptions: Some jurisdictions offer temporary or permanent property tax exemptions for the added value that a geothermal system brings to a home.

The key to unlocking these additional savings is thorough research. Websites like the Database of State Incentives for Renewables & Efficiency (DSIRE) are invaluable resources for identifying programs available in your specific area. Engaging with your geothermal installer can also be beneficial, as they often have up-to-date information on local incentives and can help navigate the application processes. By strategically combining federal, state, local, and utility programs, homeowners can significantly enhance their return on investment and accelerate the payback period for their geothermal system.

The Installation Process and What to Look For in a Contractor

Installing a geothermal heating and cooling system is a significant home improvement project that requires specialized expertise. The process typically involves several key stages, from initial site assessment and design to excavation, loop installation, and indoor heat pump integration. Understanding these steps and knowing what to look for in a contractor are crucial for a successful and efficient installation that maximizes your long-term benefits.

A reputable contractor will begin with a thorough evaluation of your home’s energy needs, soil conditions, and available space for the ground loop. This assessment will inform the design of a system perfectly tailored to your property, ensuring optimal performance and efficiency. They should also be transparent about the entire process, providing a detailed proposal that outlines costs, timelines, and expected energy savings. The quality of installation directly impacts the system’s longevity and efficiency, making contractor selection a paramount consideration.

Choosing the right geothermal installer

- Certifications and Experience: Look for contractors certified by organizations like the International Ground Source Heat Pump Association (IGSHPA) and those with a proven track record in geothermal installations.

- References and Reviews: Ask for references from previous clients and check online reviews to gauge customer satisfaction and reliability.

- Comprehensive Proposals: Ensure the contractor provides a detailed proposal covering all aspects of the project, including equipment, labor, excavation, and warranty information.

- Permitting and Compliance: A good contractor will handle all necessary permits and ensure the installation complies with local building codes and environmental regulations.

The actual installation involves careful excavation for the ground loop, which can be either horizontal (requiring more land) or vertical (requiring less land but deeper drilling). Once the loops are in place and connected, the indoor heat pump unit is installed and integrated with your home’s existing ductwork or radiant heating system. Commissioning and testing are the final steps, ensuring the system operates correctly and efficiently. Investing time in selecting a qualified and experienced contractor will pay dividends in the form of a reliable, high-performing geothermal system that delivers consistent comfort and energy savings for decades to come.

Long-Term Savings and Environmental Impact of Geothermal

Beyond the immediate financial incentives and tax credits, the decision to install a geothermal heating and cooling system is an investment in long-term savings and a commitment to environmental stewardship. Geothermal systems are renowned for their exceptional energy efficiency, leading to significantly lower utility bills compared to conventional HVAC systems. This sustained reduction in operating costs represents a continuous financial benefit that accrues year after year.

The efficiency of geothermal systems stems from their ability to simply move heat rather than generate it through combustion or resistive heating. This process consumes substantially less electricity, often reducing heating costs by 50-70% and cooling costs by 20-50%. Over the lifespan of the system, which can easily exceed 20-25 years for indoor components and 50+ years for ground loops, these savings can amount to tens of thousands of dollars, making geothermal one of the most cost-effective heating and cooling solutions available.

Key long-term benefits

- Reduced Energy Bills: Significant and consistent savings on monthly heating and cooling costs due to superior efficiency.

- Lower Maintenance: Geothermal systems have fewer moving parts exposed to the elements, leading to less wear and tear and generally lower maintenance requirements.

- Increased Home Value: Homes equipped with geothermal systems often command higher resale values due to their energy efficiency and environmental appeal.

- Reduced Carbon Footprint: By utilizing renewable earth energy, geothermal systems dramatically lower greenhouse gas emissions, contributing to a healthier planet.

From an environmental perspective, geothermal systems offer a powerful way to reduce your carbon footprint. They do not burn fossil fuels, eliminating on-site emissions of greenhouse gases and other pollutants. Even the electricity used to power the heat pump is often sourced from increasingly renewable grids, further enhancing their clean energy profile. Choosing geothermal means contributing to cleaner air, conserving natural resources, and fostering a more sustainable future. The combination of substantial long-term financial savings and profound environmental benefits makes geothermal heating and cooling a compelling choice for any homeowner looking to make a lasting positive impact.

| Key Benefit | Description |

|---|---|

| Federal Tax Credit | 30% of installation costs, no upper limit, through 2032. |

| Long-Term Savings | Significantly reduced monthly utility bills (50-70% heating, 20-50% cooling). |

| Environmental Impact | Reduced carbon footprint and reliance on fossil fuels. |

| Increased Home Value | Geothermal systems enhance property value and attractiveness to buyers. |

Frequently Asked Questions About Geothermal Benefits

The primary federal benefit is the Residential Clean Energy Credit, offering a 30% tax credit on the total cost of a geothermal heating and cooling system. This credit has no upper limit and is available for systems installed through 2032, significantly reducing the upfront investment for homeowners.

No, there are no income limitations to claim the federal Residential Clean Energy Credit for geothermal systems. As long as you have a federal income tax liability, you can claim the 30% credit, making it accessible to a wide range of homeowners across the United States.

Yes, in most cases, you can combine the federal tax credit with state, local, and utility company incentives. This stacking of benefits can further reduce your out-of-pocket expenses and accelerate the payback period for your geothermal system, making the investment even more financially attractive.

Eligible costs include the geothermal heat pump itself, all installation labor, necessary ductwork modifications, excavation for the ground loop, and any other components essential for the system’s operation. It’s crucial to keep detailed records of all these expenses for accurate tax filing.

Geothermal systems are highly durable, with indoor components lasting 20-25 years and ground loops often exceeding 50 years. Maintenance requirements are typically low, mainly involving routine filter changes and annual check-ups by a qualified technician to ensure optimal performance and longevity.

Conclusion

The prospect of installing a geothermal heating and cooling system in 2025 presents a unique confluence of environmental responsibility, energy independence, and substantial financial incentives. With federal benefits potentially exceeding $8,000 through the robust 30% Residential Clean Energy Credit, coupled with various state, local, and utility programs, the accessibility of this advanced technology has never been greater. Homeowners are empowered to make a choice that not only secures significant long-term savings on utility bills and enhances home value but also profoundly contributes to a sustainable future. By understanding the technology, leveraging available incentives, and partnering with experienced professionals, transitioning to geothermal is a strategic investment that pays dividends for decades to come.